Home insurance is essential for homeowners, especially as the Canadian real estate market continues to grow and evolve. In recent years, home insurance trends have been shaped by several factors, including changes in consumer preferences, technological advances, and the impact of natural disasters.

For 2023, it’s important to take a closer look at the home insurance trends in Atlantic Canada in 2023, where the market is influenced by its unique challenges and opportunities.

Home Insurance Trends in Atlantic Canada 2023

Rising Premiums

One of the biggest challenges facing homeowners in Atlantic Canada is the rising cost of home insurance premiums. This is partly due to the increased frequency and severity of natural disasters, such as hurricanes and coastal storms, which can cause significant damage to homes and infrastructure. Additionally, the high cost of building materials and labor, combined with the aging of the region’s housing stock, has also contributed to the rise in insurance premiums.

Cyber Risks

Another trend impacting the home insurance market in Atlantic Canada is the growing threat of cyber risks. With more and more people relying on technology and connected devices in their homes, there is an increased risk of cyber attacks, such as hacking and data breaches. Home insurance policies that cover these risks are becoming increasingly popular as homeowners look for ways to protect themselves against these growing threats.

Technology Adoption

Another trend affecting the home insurance market in Atlantic Canada is the increasing adoption of technology. Technology is changing how homes are managed and protected, from smart home devices, such as security systems and home automation systems, to drones and other unmanned aerial vehicles. Home insurance companies are now offering policies that cover these new technologies, providing homeowners with even more options for protecting their homes and families.

Insurance Deregulation

In recent years, there has been a trend towards insurance deregulation in Atlantic Canada, aiming to increase competition and improve consumer choice. This has led to the entry of new players into the home insurance market, providing homeowners with more options and a more comprehensive range of products and services. However, it has also raised concerns about the impact on consumer protections and the ability of insurance companies to provide adequate coverage in the face of rising costs and complex risks.

Increased Awareness of Flood Risks

With many areas of the region at risk of coastal flooding, homeowners are becoming more concerned about the potential impacts of rising sea levels and increased storm activity. As a result, many insurance companies are now offering specialized flood insurance policies, providing homeowners with a way to protect themselves against the costs of flood damage.

Despite these challenges, the home insurance market in Atlantic Canada remains strong, with many homeowners choosing to invest in insurance policies to protect their homes and families. As the market continues to evolve, it’s vital for homeowners to stay informed about the latest trends and to work with insurance professionals to find the coverage that best fits their needs.

One way to do this is by working with a Canadian insurance broker, who can help you navigate the complex and ever-changing home insurance landscape. Brokers have a deep understanding of the market. They can help you find the best coverage for your specific needs at an affordable price. They can also provide valuable advice and support, allowing you to make informed decisions about your insurance coverage.

The home insurance market in Atlantic Canada is facing many challenges and opportunities as we move into 2023. From rising premiums and cyber risks, to the increasing adoption of technology and insurance deregulation, homeowners must stay informed and be proactive in protecting their homes and families.

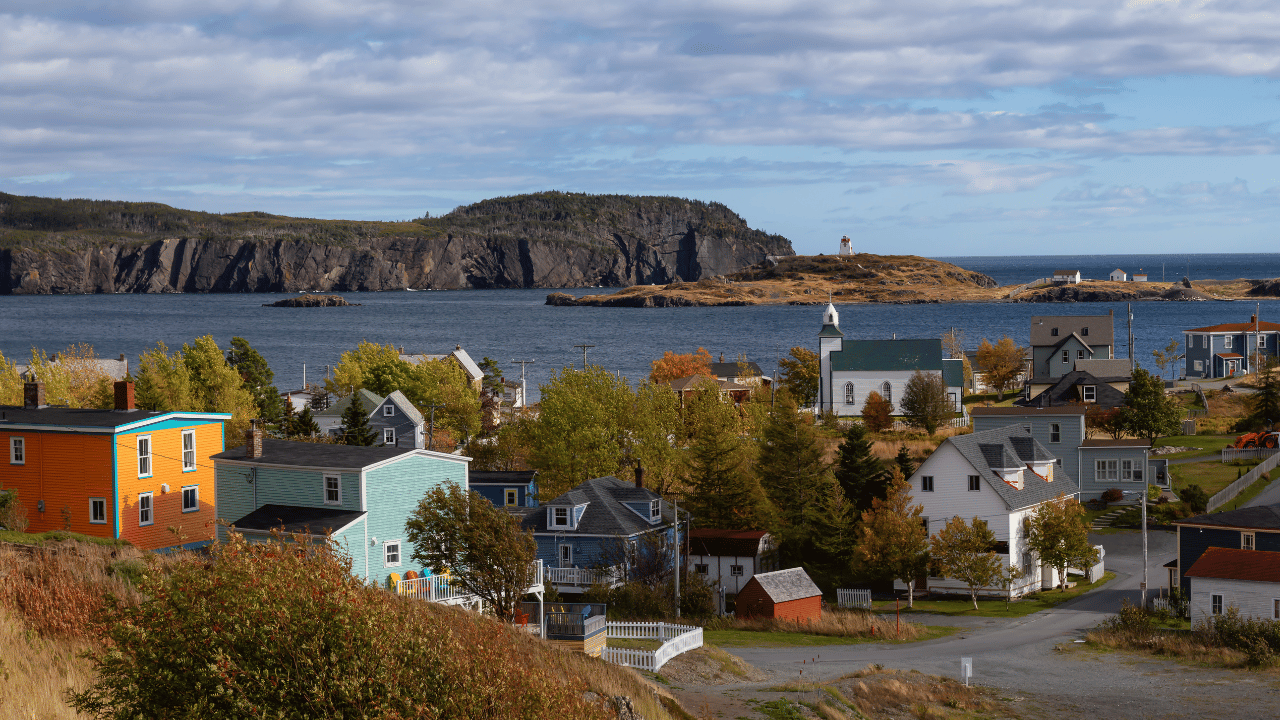

About Wedgwood Insurance

Wedgwood Insurance has offices in St. John’s & Corner Brook and is Newfoundland & Labrador’s largest independent insurance broker. We provide straightforward home, auto & business insurance advice.

With over 240 Google My Business reviews, experience the Wedgwood difference with expert advice from our dedicated team. We ensure that every client has the coverage that best suits their needs through upfront complimentary consultations and midterm reviews.