Parents of newly licensed drivers are often amazed by the high cost of adding their teenage driver to their automobile insurance policy. While managing insurance costs is surely important for every family, helping teenage drivers reduce their vulnerability to a life-changing accident should be a much greater concern than the high cost of insurance.

The High Cost Should Be Alarming

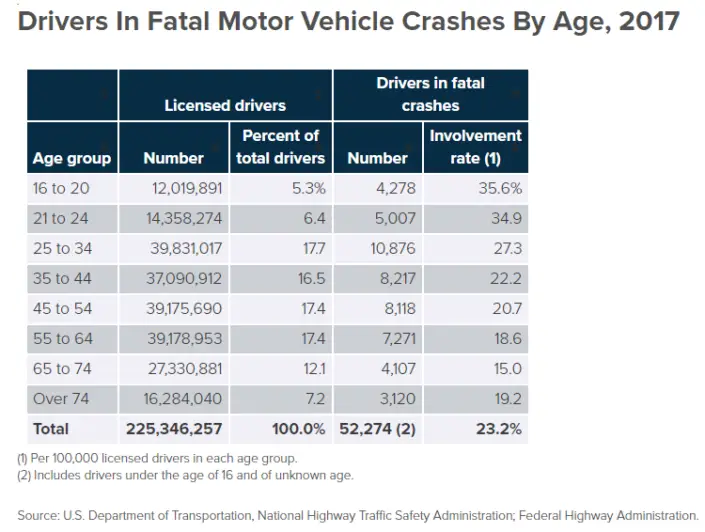

The high cost to insure teen drivers reflects the much greater risk to insure inexperienced drivers, and those greater risks should also concern parents and teens. Stated simply, younger, inexperienced drivers are not only more frequently involved in accidents, those accidents are often much more severe. This table reveals that teenage and young drivers age 21-24 have the highest fatality rates of all drivers in a study conducted by the National Highway Safety Administration.

Other factors to be aware of:

- Automobile accidents are the number one killer of our nation’s youth.

- Drivers under the age of 20 were involved in 13 percent of all accidents, yet they account for only 5 percent of all drivers.

- 5,000 teenagers die each year from auto accidents.

- Alcohol is responsible for almost half of all teen motor vehicle deaths.

- 25 percent of all teen accidents involve speeding.

- Half of all teenage traffic fatalities occur between 6 p.m. Friday and 3 a.m. Sunday.\

- In one year, drivers 19 and under were involved in close to 3 million motor vehicle accidents.

Source: Insurance Information Institute

The Reasons for the Alarming Statistics

There is ample research and a lot of helpful content to provide teens and their parents with the important answers explaining why the risks are so great. The Centers for Disease Control and Prevention (CDC) provides this excellent two-page document, “Eight Danger Zones for Teens Behind the Wheel,” which highlights the following risk factors that are most important to manage, and prescribes the actions parents can take to reduce each of these risks.

The CDC’s Eight Danger Zones:

- Driver Inexperience

- Driving with Teen Passengers

- Nighttime Driving

- Not Using Seat Belts

- Distracted Driving

- Drowsy Driving

- Reckless Driving

- Impaired Driving

A Rapidly Growing Risk: Distracted Driving

While statistics indicate impaired driving among teens is on a modest recent decline, few will be surprised to learn that distracted driving is a rapidly increasing trend among teenagers. In a 2015 study incorporating the use of video to examine the causes of accidents involving teenage drivers, the AAA Foundation for Traffic Safety found significant evidence that distracted driving is a far more significant risk than previously known. AAA’s unprecedented video analysis revealed driver distraction was a factor in nearly 6 out of 10 moderate-to-severe teen crashes — four times higher than was previously estimated on police accident reports.

Many Resources Available to Manage These Risks

Parents of teenage drivers should be aware of the many effective resources and free tools to help them establish clear expectations and safe driving practices, including the following:

- Parent-Teen Driving Agreement — CDC

- The New Driver Deal — Drive It Home

- 7 Free Apps to Prevent Texting While Driving — HONK

What teens drive matters greatly. The criteria used by teens (and even parents) in selecting a first car rarely prioritizes safety. Parents should rely on the Institute for Highway Safety (IIHS) in selecting a vehicle well rated for safety. At a minimum, that means good ratings in the IIHS moderate overlap front test, acceptable ratings in the IIHS side crash test, and four or five stars from the National Highway Traffic Safety Administration (NHTSA).

Especially considering the heightened focus on distracted driving, parents should feel especially motivated to protect their family’s least experienced and most vulnerable drivers. The resources spotlighted in this article provide a great opportunity for families with teen drivers to reduce the risk of accidents and heartache. Independent insurance brokers who serve their clients as personal risk advisers are also a great resource to help their clients understand how best to manage this risk.

Tim O’Brien

SVP, Property & Casualty

Assurex Global